The Door County Board of Supervisors last week approved the 2024 Door County budget and tax levy during a public hearing and County Board meeting.

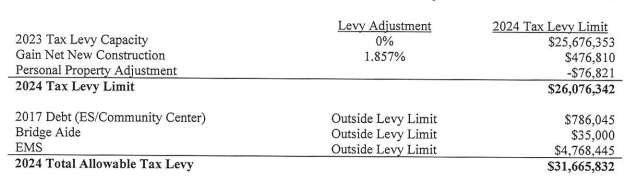

The total amount allotted in the budget is $107.3 million. The total allowable tax levy for 2024 is $31.7 million. The approved tax rate for 2024 is $2.61 per thousand dollars of equalized value.

The county’s 2024 budget has decreased from the adopted 2023 budget of $108.9 million but increased from the adopted 2022 budget of $81.6 million. The total tax levy has increased 3.18 percent.

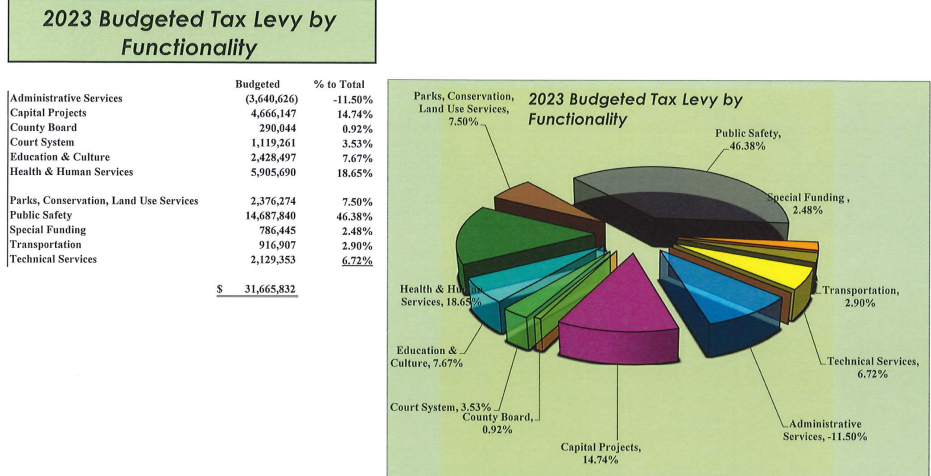

The tax levy is the 2023 tax levy plus the net new construction and personal property adjustment. The personal property adjustment is dependent on the county’s assessment of property taxes each year. To this new total, debt from past projects and expenditures are added to give the total allowable tax levy for 2024.

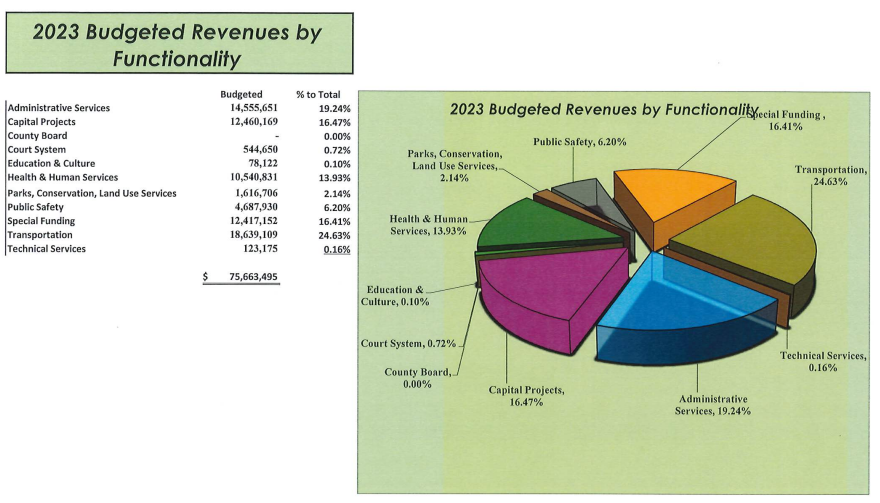

The remainder of the budget, beyond the tax levy, is covered by other revenues. Revenue has decreased from $78.2 million in 2023 to $75.7 million in 2024. Revenue heavily impacts the budget for the upcoming year.

The county’s tax rate has gone down significantly since the early years of the pandemic, with the peak being $4.18 in 2019. The 2024 tax rate is the lowest rate the county has seen in the 21st century. It has decreased 15.95 percent since the 2023 budget. The tax rate depends on equalized value, which has increased 22.76 percent since the 2023 budget. As value goes up, tax rates go down to ensure the county stays within the state-imposed limit on the amount of money the county can raise in property taxes.

Door County’s equalized value (value based on assessed taxable property values) has been on a steady increase since 2001, with a dip in 2010. The county’s allowed total tax levy has also been steadily increasing since 2001.

“Our housing values have been increasing exponentially,” said county administrator Ken Pabich. “We’ve experienced that and that actually hits us in terms of the housing crisis we’re having and affordable housing.”

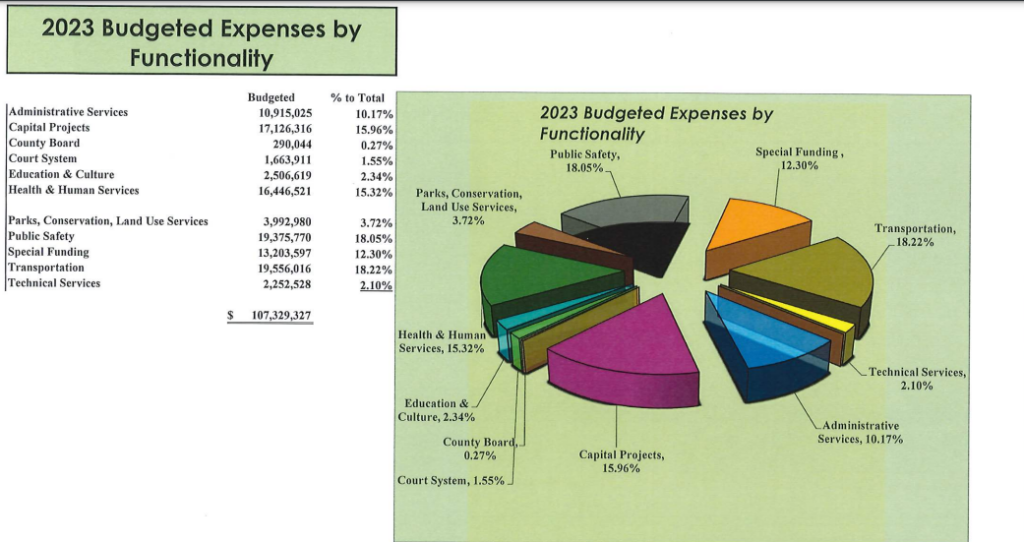

In his presentation to the County Board, Pabich used breakdowns of the 2023 budget as a reference point for describing where funds come from and how they are spent.

The largest recipient of the tax levy budget in 2023 is public safety, which makes up 46.38 percent of the tax levy budget. This category includes the departments of 911 dispatch, emergency services and management, medical examiner, and the Sheriff’s Office.

The Sheriff’s Office is the largest recipient of funds in the category of public safety, followed by emergency services and management. The total budget for the Sheriff’s Office for 2024 stands at $10.1 million. The 2024 budget for emergency services and management is $7.6 million.

The largest recipient of the county budget as a whole in 2023 is transportation, which makes up 18.22 percent of the overall budget. This is followed closely by public safety at 18.05 percent. Transportation includes the airport department, highway fund, county roads, bridges, and recycling, and a general “transportation” category.

The highway fund will receive the largest amount of funding in this category in 2024 with $11.9 million.

Although public safety is the largest recipient of the tax levy funds, it is one of the lowest contributors to the county’s annual revenue.

Transportation is the largest contributor to the county’s annual revenue, accounting for 24.63 percent of revenue. This is followed by administrative services, which include the county administrator, corporation counsel, county clerk, county treasurer, finance department, general administration, human resources, and facilities and parks (parks are reported separately). Administrative services as a whole make up 19.24 percent of revenue. The largest contributor to this category is general administration, which consists mostly of taxes.

The total revenue projected to be generated by general administration in 2024 is $5.7 million.

Most departments which will be receiving more or less funding in 2024 than in 2023 will be doing so as a result of changes in wages and staffing.

“About 37.7 percent of our entire expenditures are based on our employees,” Pabich said.